The performance-driven fund

SproutBridge Equity Fund

Invest in the global stock market.

Why SproutBridge

Investing in stocks without the limitations of benchmarks

SproutBridge Equity Fund was established as a performance fund to achieve optimal returns for its investors without the limitations of benchmarks, but with a combination of strategies and a dampening effect in riskier market conditions.

Shared interest

Risk reduction

SproutBridge Equity Fund limits risks by spreading the equity portfolio across different sectors, styles, countries and market capitalizations.

Performance-driven fund

The fund manager is rewarded based on performance.

Rigorous stock selectie procedures

Investing using strategies

Select one of the strategies on the left

The portfolio is subject to changes

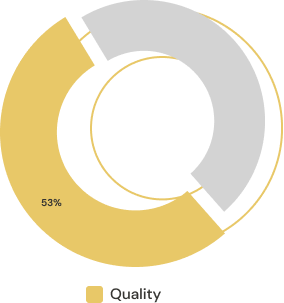

Quality strategy

Description: strong companies with robust earnings.

The quality strategy focuses on robust earnigns, financial health and realistic valuations. The fund selects a robust portfolio of quality companies for long-term value creation.

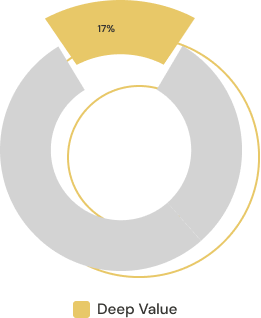

Deep value strategy

Description: companies with share prices far below liquidatuion value.

The deep value strategy is a robust method for high returns by investing in smaller companies with a targeted approach to identify undervaluation and avoid value traps, a strategy typically only deployed by smaller investment funds.

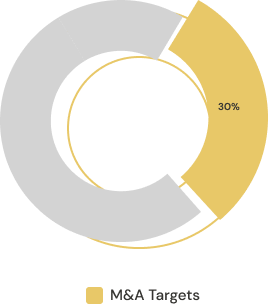

M&A target strategy

Description: companies which have received a public takeover bid.

This strategy and associated group of stocks offer protection to the fund portfolio in declining markets. It is a very select group of takeover candidates and correlation-reducing stocks for convincing investments with minimal risks.

The global stock market

Discover the different options

Fund teaser

Learn more about SproutBridge Equity Fund and its investment strategies.

Learn more about SproutBridge Equity Fund and explore investing in the global stock market. Be informed about our manager, the optimization of returns and risk management.

Fund participant

Capital growth by an experienced fund manager.

Outsource investing by participating in the SproutBridge Equity Fund. Benefit from an experienced manager for optimal returns and efficient risk management.

More information about the different options

The different stages of your investment

Capital growth enabled by professional fund management

I. An introductory meeting

You are invited to our office where we will welcome you and provide you with further information about SproutBridge. We can also set up an online meeting or meet you at a different location.

II. Intake and allocation

After a successful intake by our administrator AssetCare, we will invest your investment in the SproutBridge Equity Fund.

III. Regular investment updates

We will send you quarterly updates regarding your investment and our performance.

IV. Enjoy the returns

As an investor in SproutBridge Equity Fund you will benefit from our investments in the global stock market.

Your fund manager

Rick Boerkamp

Every day I encountered the limitations of benchmarks on investment strategies within funds, which resulted in a reduced number of investment opportunities. SproutBridge Equity Fund was established as a performance fund to achieve optimal returns for its investors without the limitations of benchmarks, but with a combination of strategies and a dampening effect in riskier market conditions.

Start a conversation with our fund manager

Discover the possibilities

Schedule an introductory meeting.