Unleash the potential of investing in the global stock market

Investment product

Rising value, global return opportunities.

How the stock market continuously beats inflation.

Inflation protection

Stocks as protection against inflation

The stock market has historically outpaced inflation. Stocks provide protection against inflation because companies are often able to pass higher costs on to consumers, increasing profits. Jeremy Siegel, a professor at the Wharton School, has shown that US stocks outperform inflation by an average of 6.7% annually over a very long period of time, further underscoring the attractiveness of stocks.

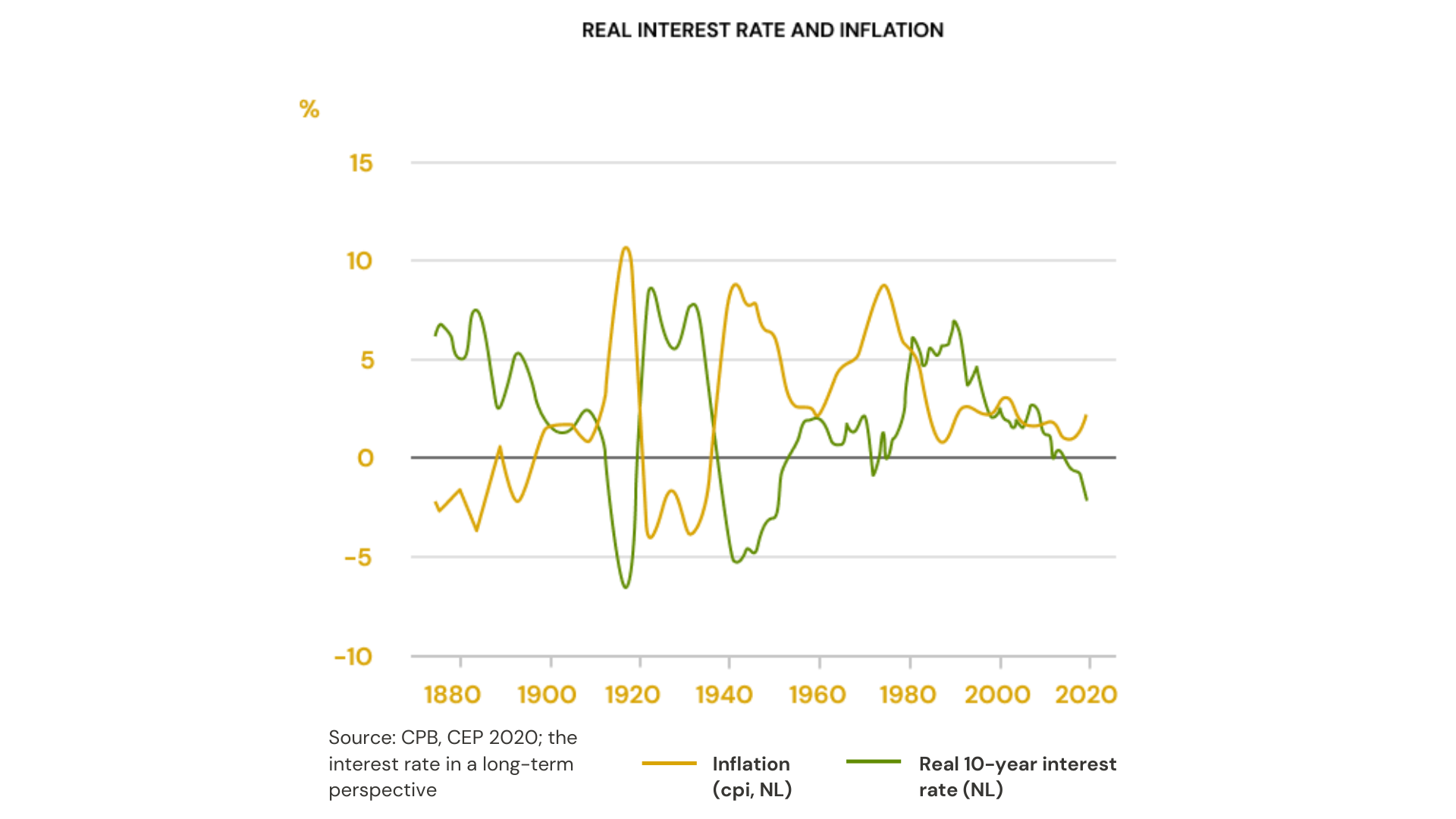

Even traditional options, such as savings deposits or government bonds with a term of 10 years, do not guarantee a positive real return, as data from the Central Planning Bureau (CPB) shows. On several occasions in recent decades, real 10-year interest rates have been negative, meaning returns on such investments have not kept pace with inflation.

Compounding

Long-term investing

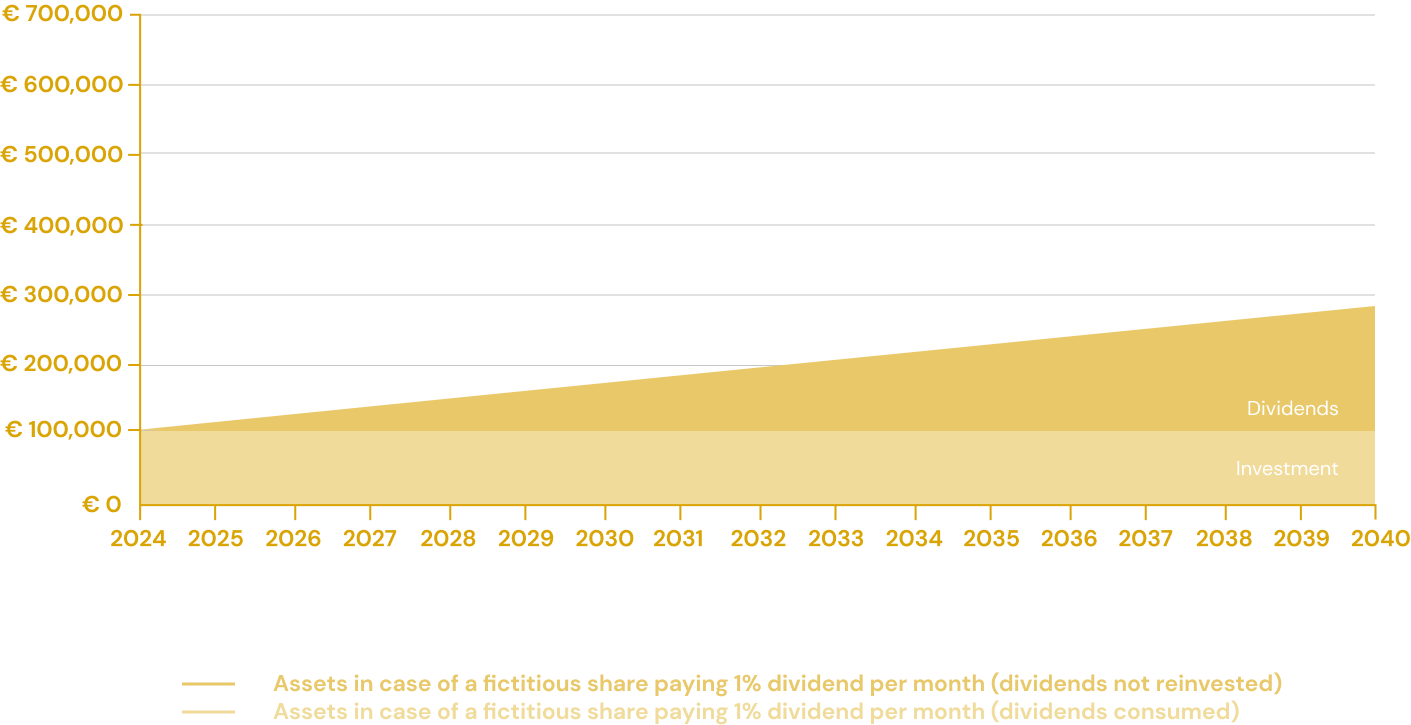

Why choose for long-term investing? Optimal returns can be achieved in the long term by one principle; ‘compounding’. With compounding, the earned return is reinvested. In this way, the returns you achieve also generate returns and you ensure exponential growth in the long term.

As Albert Einstein aptly said:

“Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.”

Visualization of assets with and without compounding

The global stock market

Discover the different options

We offer several options to invest in the global stock market with SproutBridge. Learn more about our options or navigate to the investment opportunities.

Fund participant

Capital growth by an experienced fund manager.

Outsource investing by participating in the SproutBridge Equity Fund. Benefit from an experienced manager for optimal returns and efficient risk management.

Invest in stocks yourself

Beyond benchmarks: unleash the potential of investing in the global stock market

Learn more about different stock investment strategies.

Disclaimer: no financial advice.

More information about the different options

White Paper

Beyond benchmarks: unleash the potential of investing in the global stock market

Learn more in this documentation about the activities of fund manager SproutBridge.

Rigorous stock selection procedure

Investing using strategies

Select one of the strategies on the left

THE PORTFOLIO IS SUBJECT TO CHANGES

Quality strategy

Description: strong companies with robust earnings.

The quality strategy focuses on robust earnings, financial health and realistic valuations. The fund selects a robust portfolio of quality companies for long-term value creation.

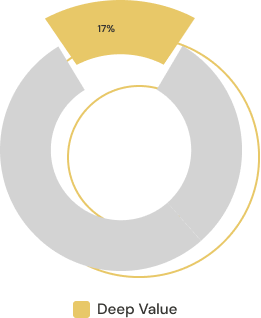

Deep value strategy

Description: companies with share prices far below liquidation value

The deep value strategy is a robust method for high returns by investing in smaller companies with a targeted approach to identify undervaluation and avoid value traps, a strategy typically only deployed by smaller investment funds.

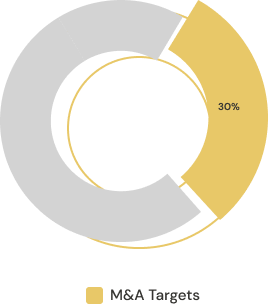

M&A target strategy

Description: companies which have received a public takeover bid

This strategy and associated group of shares offer protection to the fund portfolio in declining markets. It is a very select group of takeover candidates and correlation-reducing stocks for convincing investments with minimal risks.

Equity fund

SproutBridge

SproutBridge Equity Fund exists to provide investors strong investment returns without the limitations of benchmarks, but with a combination of strategies and a dampening effect in risky markets.

More information about the fund

More information about our fund

Request the teaser

Request our teaser without any obligation.